confronto

- marginal costing fixed production costs are treated as period costs and are written off as they are incurred

- absorption costing fixed production costs are absorbed into the cost of units and are carried forward in inventory to be charged against sales for the next period

calcolo

Dati

| Per unit |

$ |

| Selling price |

180.00 |

| Direct materials |

40.00 |

| Direct labour |

16.00 |

| Variable overheads |

10.00 |

- annual fixed production overheads are budgeted to be $1.6 million

- produce 1,280,000 units each year

- actual overheads are $1.6 million for the year

- budgeted fixed selling costs are $320,000 per quarter

- actual sales and production units for the first quarter of 20X8

- Sales 240,000

- Production 280,000

calcolo:

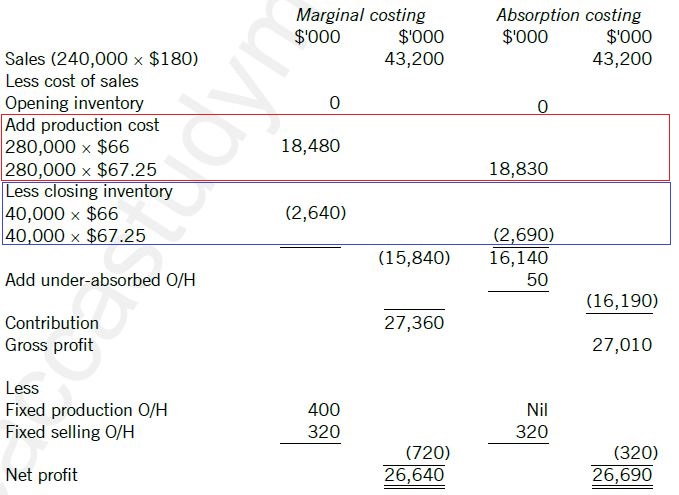

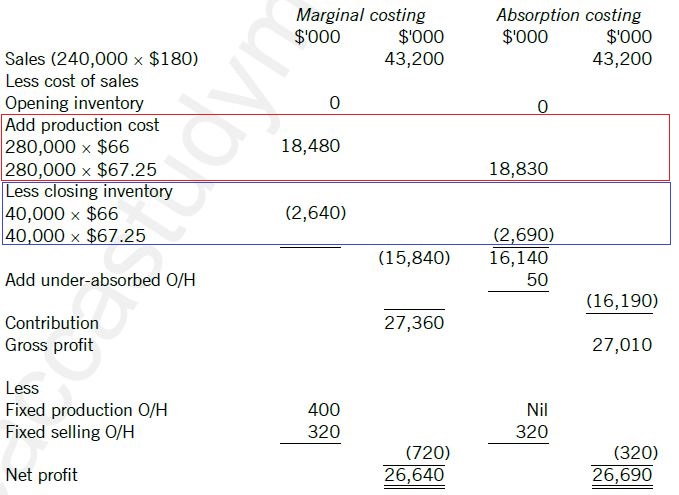

- marginal costing

- absorption costing

procedure

- calculate the overhead absorption rate per unit

overhead absorption rate is based only on budgeted figures

Overhead absorption rate = Budgeted fixed overheads

Budgeted units

Budgeted overheads (quarterly) = $1.6 million / 4 = $400,000

Budgeted production (quarterly) = 1,280,000 / 4 = 320,000 units

Overhead absorption rate per unit = $400,000 / 320,000 = $1.25 per unit

- calculate total cost per unit

Total cost per unit (absorption costing) = Variable cost + fixed production cost = (40 + 16 + 10) + 1.25 = $67.25

Total cost per unit (marginal costing) = Variable cost per unit = $66

- calculate closing inventory in units

Closing inventory = Opening inventory + production – sales

Closing inventory = 0 + 280,000 – 240,000 = 40,000 units

- calculate under/over absorption of overheads

this is based on the difference between actual production and budgeted production

Actual production = 280,000 units

Budgeted production = 320,000 units (Budgeted production (quarterly))

Under-production = 40,000 units

absorption of overheads of 40,000 x $1.25 = $50,000

- produce statements of profit or loss